In Brazil, navigating the tax system can seem complex. Understanding the difference between CNPJ and CPF is a crucial first step. This guide clarifies the purpose and application of each identification number.

We are here to help. Have a chat with one of our accountants, they will take you from there

The CNPJ (Cadastro Nacional da Pessoa Jurídica), or National Registry of Legal Entities, is a unique 14-digit number assigned to businesses and legal entities registered in Brazil. It serves as the primary tax identification number for companies. Any registered business in Brazil, regardless of size or structure, needs a CNPJ. This includes foreign companies operating or investing in the country. The CNPJ is essential for various business activities such as opening bank accounts, issuing invoices and receipts, paying taxes, complying with legal and financial obligations, and participating in government programs.

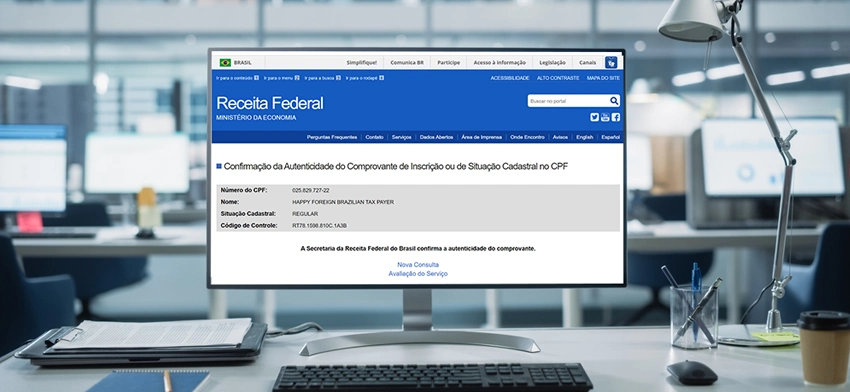

The CPF (Cadastro de Pessoas Físicas), or Registry of Individuals, is an 11-digit identification number assigned to all Brazilian citizens and residents over 14 years old. It acts as the primary tax ID for individuals. Both Brazilian citizens and residents, employed or not, require a CPF. Foreigners working in Brazil or receiving Brazilian income also need one. A CPF is used for various personal financial activities, including filing tax returns, opening individual bank accounts, receiving employment income, purchasing property, and accessing certain government services.

Understanding the difference between CNPJ and CPF is essential for anyone navigating the Brazilian financial and tax system. A CNPJ is required for businesses, while a CPF is for individuals. Both are crucial for various financial activities. If you require assistance with obtaining a CNPJ, CPF, or navigating Brazilian tax regulations, our team of experienced accountants is here to help. Contact us today to discuss your specific needs!